Remember 2019? Back then supply chain logistics, access to raw materials, shipping and truck costs were united by one principle: efficiency.

The more quickly and easily businesses could get what they needed, the better. Premiums were paid to shave hours off delivery time; the cost of manufacturing was predictable and the availability of parts was known. In those conditions, instant pricing was king. Most online solutions for on-demand manufacturing heavily relied on an instant quoting algorithm. It calculated the manufacturing costs of engineered parts by computing the cost of raw materials, processing tools, and labor. The pandemic and the subsequently unprecedented supply chain issues rattled the manufacturing ecosystem and how parts get priced–perhaps permanently.

The Instant Quoting Algorithm Isn’t Working Under Current Market Forces

In June 2022, Thomson Reuters Industry Analyst Bryce Engelland wrote, “Before the pandemic, the global supply chain was optimized to provide efficiency with the demands of just-in-time manufacturing; but during the course of the pandemic, this approach has been hamstrung by disruption.”

“The pandemic caused port delays, transport aircraft shortages, and halts in component manufacturing which have resulted in extreme uncertainty in delivery times, which in turn cause further disruptions.”

With uncertainty and disruption normalized, the instant pricing model has a crippling drawback. It only can estimate the theoretical cost of producing an engineered part. It cannot accurately estimate the price the market currently offers.

For example, how can the algorithm estimate shipping costs during an inflationary period? New research from the International Monetary Fund indicates shipping costs may continue to build until the end of 2022.

How could instant pricing estimate the cost of raw nickel, for example, which soared to record-highs out of nowhere this spring? With the ongoing conflict in Ukraine, access to precious metals has been tightening for months.

There are simply too many unknown variables getting plugged into the instant pricing algorithm.

The consequences of the gap between estimating the cost production versus actual price can be financially catastrophic for buyers. When there is no bid, there is no competition. This results in cost reductions no longer being guaranteed.

Exclusively relying on instant pricing reduces competition. The algorithm only returns one price. There’s no bidding process. If there’s no bidding, there’s no way to introduce more competitive pricing strategies.

What Supply Chain Managers and Manufacturers Need During the Pandemic

Supply chain managers face never-before-seen challenges in procurement, which has significant downstream effects for any technology or manufacturing company that are prototyping during the pandemic.

In our ongoing interactions with manufacturers and supply chain managers, the team at ManuFuture has identified four key challenges both groups want to overcome with automated solutions.

- Cost reduction. Specifically, the rollercoastering costs of raw materials and shipping efforts make prototyping and production less profitable for organizations and, at times, even cost prohibitive.

- Increased agility. Agility is the biggest buzzword in pandemic supply chain management. How seamlessly can supply chain managers and manufacturers deploy and adapt to new technology? How can they work to cut down the lead time for a quote, without losing accuracy, and reduce the time it takes to deliver components?

- Bottlenecks, bottlenecks, bottlenecks. Everyone is looking for the fastest, latest, cheapest digital solution for supply chain management. That usually comes in the form of a completely automated solution to the pandemic’s relentless supply chain bottlenecks.

- Supply chain restructuring. As companies restructure their supply chain, they’re reshoring to developed countries and nearshoring to reduce demands on shipping from China and other countries heavily impacted by COVID shutdowns. They want automated solutions to help them stay nimble with short batches and demand forecasting.

Supply Chains Already Use Machine Learning for Planning, But Face Challenges Implementing Them.

In a February 2022 report, McKinsey & Company writes that four out of five supply-chain leaders expect to or already use AI and machine learning for planning. Despite the vast majority of supply chain managers buying into AI, both literally and figuratively, they cited significant challenges to implementing the new systems.

They pointed to the staggering costs associated with an upgrade as a major obstacle, but most importantly, they described their biggest pain point as the time it took to fully implement the new software system.

Bidding Models Have Always Worked. Now They’re Our Only Option for Prototyping and Production.

The manufacturing supply chain has always used bidding as a way to ensure competitive costing. It allows a set of qualified suppliers to compete on manufacturing capacity, delivery time, and price.

At most tech companies, bidding is part of their protocol for prototyping and production. Why? Proper bidding can cut the prices of custom manufacturing in half while maintaining a high level of quality. Our sources estimate instant quoting algorithms ultimately can result in custom manufacturing that’s twice the cost of proper bidding.

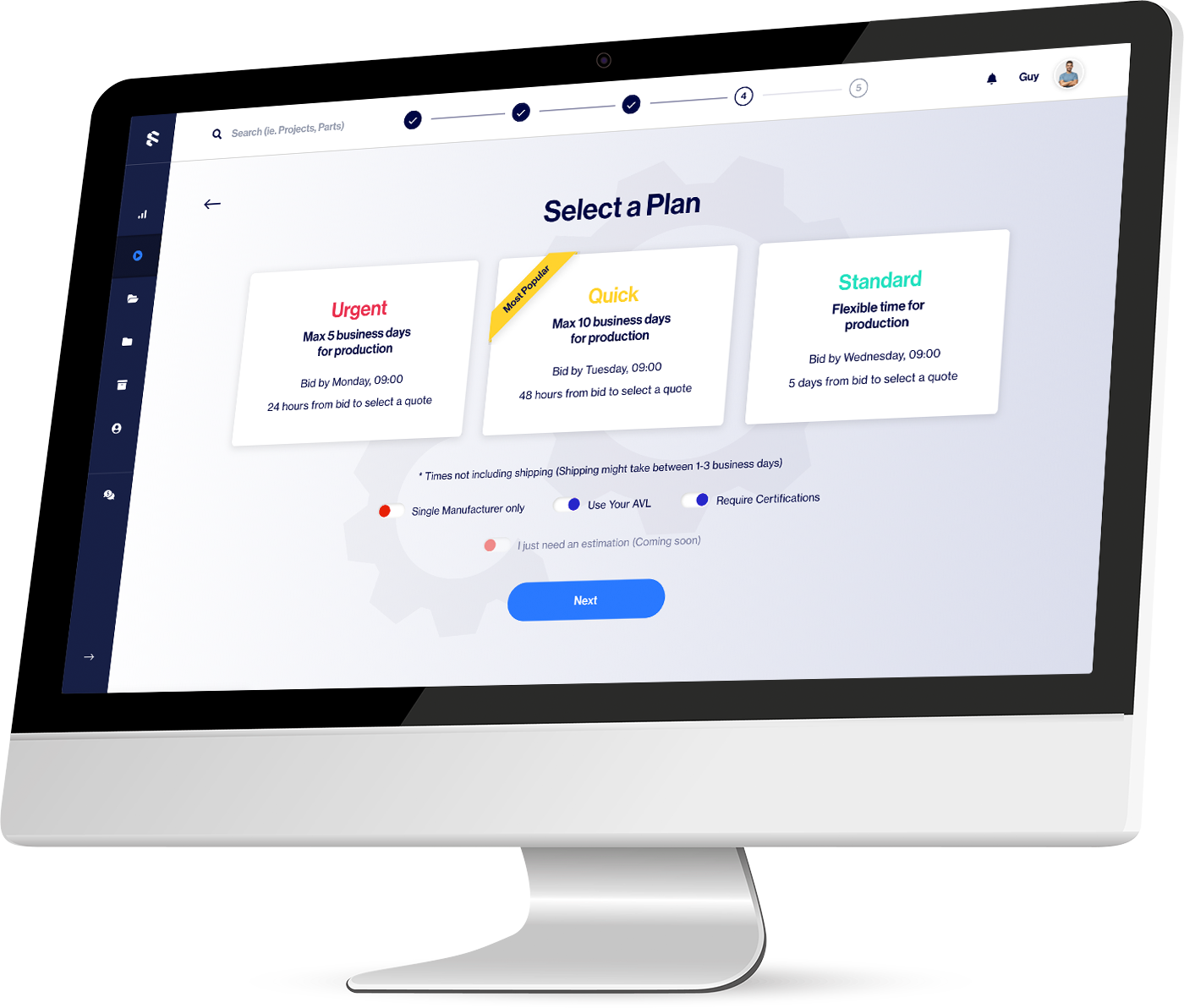

ManuFuture’s match-and-bid algorithm has produced custom manufacturing bids with even more dramatic cost savings, between 200% and 400% in some examples. Our platform focuses on achieving optimal bid results, requiring all bids to be anonymous and independent. It matches the supplier’s manufacturing capabilities, lead time, and total cost while offering a true “apples to apples’ ‘ comparison between bidders.

Why Bidding is Outperforming Automated Quoting in the New Normal

Bidding models are currently outperforming instant automated quoting for the following reasons:

- Cost structures vary. Suppliers will always have different cost structures depending on their geographic location, the company’s size, and machining capabilities.

- Availability trumps everything. The availability of raw materials and manufacturing capabilities overcome theoretical costing. Even if a factory is bidding with lower margins, it’s likely being underutilized.

- The cost of a vendor’s learning curve. Every vendor assesses risk differently and, as result, experiences their own learning curve costs.

- Manufacturing expertise. Just because a company receives an enticing, lower priced bid doesn’t mean the supplier is an appropriate fit for the job. A smart match-and-bid model algorithm finds the most fitting suppliers, submits their price, and bids for every job the system offers them.

The Bidding Model’s Success is the Market Self-Correcting

As we adapt to market forces in our current supply chain environment, ManuFuture holds firm on the idea that pricing based on machine learning will become ubiquitous in the manufacturing sector. Without it, manufacturers will struggle to stay profitable and compete in an open market.

It’s important to note that all sourcing platforms and tools are not created equal. The most effective platforms will focus on using machine learning to match manufacturing capacity, lead time, geographic location, and manufacturing expertise instead of exclusively honing in on price.