What is a marketplace?

Marketplaces have been a key part of human society for centuries, providing a platform for people to trade and exchange goods and services. In the past, marketplaces were typically local and had a limited number of participants. However, with the advent of the internet, global marketplaces have emerged, allowing people from all over the world to buy and sell goods.

As marketplaces have grown in size and complexity, there has been increasing interest in how to optimize the allocation of goods and services within these platforms. Some of the key questions that have been raised include: what outcomes do stakeholders prefer, how should incentives be structured, and should technology disruption alter established mechanisms for optimal outcomes?

Pricing for Marketplaces – the endless battle

Pricing is a crucial aspect of marketplaces, as it determines how much buyers are willing to pay for goods and services and how much profit sellers can make. However, pricing can be complex, especially when there are many options to choose from and the value of goods and services is difficult to determine. Sellers face the challenge of setting prices that result in desired outcomes (such as profit or high volume of sales), while buyers may struggle to decide between numerous deals when shopping online. Additionally, pricing mechanisms can be impersonal, as they often offer the same prices to all shoppers regardless of their budget.

In situations where buyers are only interested in a few items and there is sufficient information to accurately evaluate their value, pricing mechanisms can be effective. However, when information about the value of items is scarce or varies significantly among buyers, pricing mechanisms may be less effective. In these cases, auctions can be a useful marketplace mechanism.

Optimize allocation of goods and services with auctions

In an auction, the auctioneer sets the rules of the sale, interacts with buyers and collects bids, and ultimately declares the winners and arranges for payment. Auctions are often used in situations where buyers and sellers have limited information about each other and the value of the goods or services being sold is hard to determine. Some examples of marketplaces that use auctions include the sale of art, boutique real estate, antiques, and the United States Federal Communications Commission spectrum auctions. Auctions have a proven track record of creating high-quality allocations in these types of environments, as they allocate goods to the buyers who value them the most.

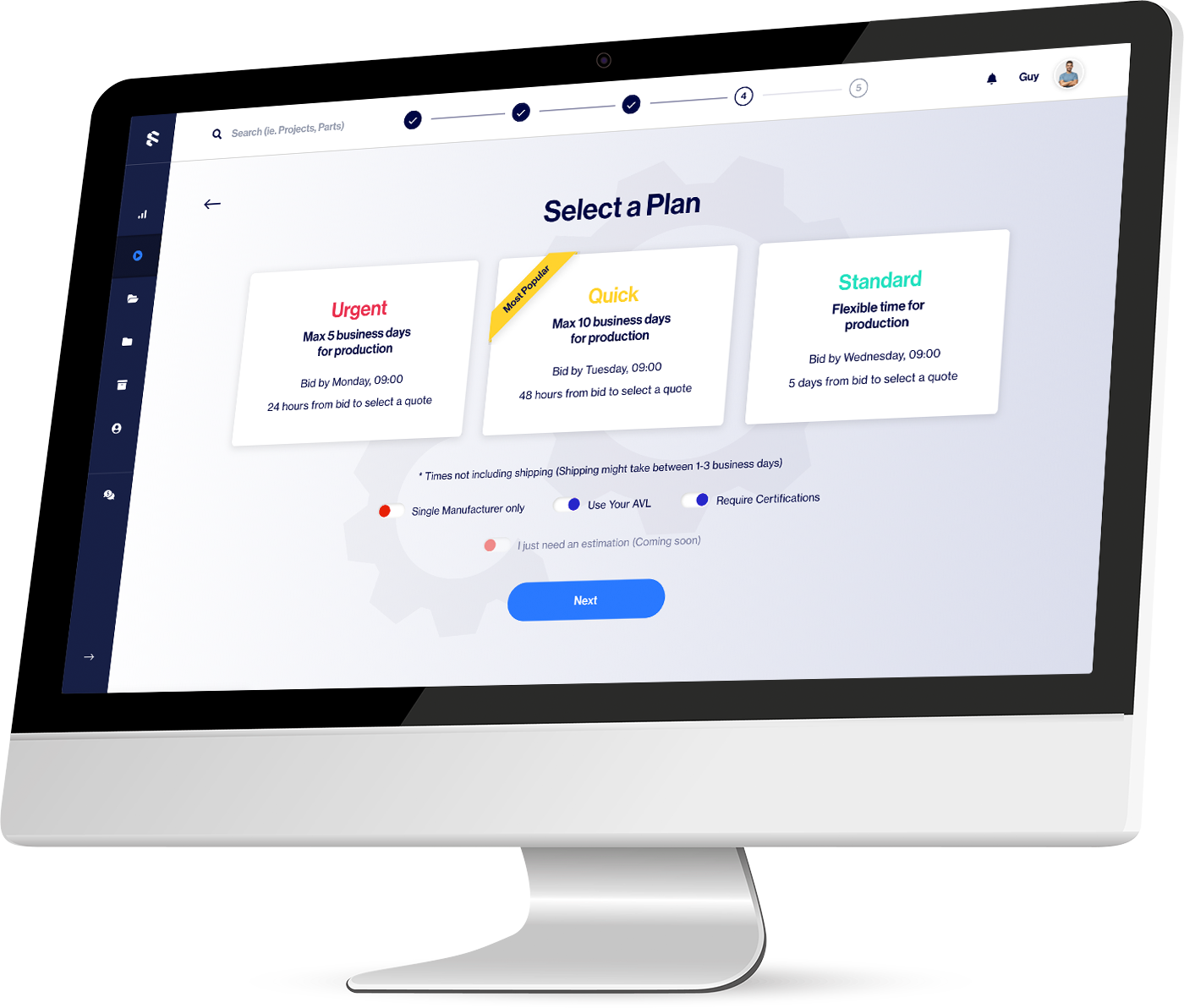

In today’s marketplaces, meeting customer demands is essential for success. ManuFuture is a marketplace for high-quality custom products that caters to personalized needs. In this type of marketplace, selecting auctions as the primary mechanism for discovering prices and allocating goods can be a good choice. This is because every buyer has specific needs and many items may only appear once. The use of auctions allows for the “invisible hand” of the market to work, producing quality results according to the specific requests for quotations (RFQs) made by buyers. However, simply using auctions is not enough. It is important to carefully design the auction process and select the right participants to ensure that it meets the desired business objectives.

In summary, marketplaces play a central role in the exchange of goods and services. While pricing mechanisms can be effective in certain situations, auctions are often a better choice when the value of items is hard to determine and information is limited. Careful design and participant selection are key to ensuring that auctions meet customer demands and achieve desired outcomes.

How marketplaces are meeting customer demands today

ManuFuture is a marketplace for high-quality mechanical custom parts catered to personalized needs, and using bidding as a discovery mechanism that seems like the right decision. Complex combinations of different items make it impossible for anyone to know what’s worth what. Incentivizing everyone who joins to bid creates strong market signals and allows “invisible hand” to work, producing quality results per RFQ. But simply deciding on auctions is not enough, there are so many options that most participants won’t matter for you and your auction. That’s why you need to design the best approach possible through intelligent auction participants selection and incentivizing the desired business objectives in one sweep.

In the world where ManuFuture operates – a marketplace of specially-tailored items for specially-tailored project – selecting bidding as the marketplace mechanism seems to be the right approach. In this environment, every buyer is essentially defining his/her desired needs. In such an environment many items will never appear twice! Combinations of items further increase complexity exponentially, and so the amount of information required to make high quality pricing decisions may not be within reach of any single entity. Applying bidding, and incentivizing the market participants to provide meaningful bids, enable creating high quality allocation decisions per-auction, i.e. letting “the invisible hand” do its thing. However, simply going with auctions is not enough by itself. In a global environment, the amount of options, participants, and details available at every auction can be potentially huge, with a vast majority of the participants being completely irrelevant to the auction. That’s where the art of designing the right matching and bidding comes into place – from selecting the right participants, through deciding how much information to provide to each supplier, and ultimately setting the bid rules that incentivize the desired business objectives.

That’s where the magic of ManuFuture happens.