Struggling with your mechanical supply chain?

You’re not the only one. Research by Accenture suggests that 94% of Fortune 1000 companies saw supply chain disruptions as a result of the pandemic.

The supply chain is composed of individuals and companies who enable products, services, finances, or information to flow from the source to the customer. They often involve large, integrated networks of technology and personnel resources. In mechanical manufacturing, supply chains involve resource extraction, manufacturers, logistics firms, and sellers.

Supply chains are becoming increasingly global and complex. And with increasing complexity, comes increasing vulnerability.

We saw that vulnerability clearly during the COVID-19 pandemic. COVID put supply chains under pressure by quickly shifting demand for goods, creating labor shortages, and causing barriers to the movement of goods. But while COVID was a significant factor in our current supply chain challenges, it’s not the only one.

Read on to find out about what’s causing the top supply chain challenges in 2022 for mechanical manufacturing, and how the experts at ManuFuture can help you ensure your supply chains don’t break down.

Challenge 1: Sudden Changes in Demand

The pandemic affected supply chains by sharply changing buying patterns.

As people worried about a crisis, there was a sudden spike in demand for household essential items like toilet paper. Later, lockdowns required people to work from home, so demand for electronics shot up. At the same time, they drove less, reducing demand for gas and cars.

The fear of a crisis also created a related demand issue: hoarding.

Singapore, for example, experienced an egg shortage as consumers bought up and hoarded the existing supply during the 2020 lockdowns. Retailers ordered as many eggs as they could to satisfy demand. Suddenly they did satisfy that demand, and consumers stopped buying eggs. The result was oversupply: In June of 2020, distributors threw out over 250,000 eggs.

Similar sudden spikes in demand were partially responsible for the shortage in semiconductor chips. As people were forced to stay home, car sales plummeted. Modern cars are made with over 3,000 microchips, controlling everything from tire pressure to the movement of car seats. As demand for new cars dried up, companies that produce chips redirected their resources to consumer electronics like laptops and phones. When demand for cars picked up again, there was suddenly a lack of chips. The shortage was made even worse as some carmakers began hoarding chips.

Challenge 2: Ongoing Challenges with Supply

There are ongoing supply obstacles for manufacturers in many industries, too—including for semiconductors.

Storms in Texas in early 2021 forced three semiconductor factories to shut down. A Japanese chip factory north of Tokyo had to close due to a fire. And Taiwan, a massive global player in semiconductor chips for cars, is experiencing a severe drought. Since it takes large amounts of fresh water to produce chips, that’s having an effect on the semiconductor chip supply.

Each of these is a contributing factor specific to the shortage in semiconductor chips. But natural disasters, extreme weather, and other environmental factors are posing risks to supply chains across industries. Their impact on supply chains is predicted to increase over time with the worsening effects of climate change.

Cost is another critical factor on the supply side. The cost of trade on major east-west trade routes has increased 80% year over year. Higher costs hinder trade. According to the United Nations Conference on Trade and Development, a 10% increase in the cost of freight can create a 1% reduction in industrial production.

Challenge 3: Labor Shortages

Producing goods and transporting them requires people. But those people are in short supply. According to research by Korn Ferry, companies around the world could face a shortage of as many as 85.2 million skilled workers by the end of the decade. These shortages are especially pronounced in advanced economies like the United States.

For mechanical manufacturing, one critical shortage of labor is among truck drivers and other transport workers. There are several reasons for this, but a few important ones stand out. Research on truck drivers in the UK suggests that the lack of work-life balance, long hours, and relatively low pay push people out of the industry. And as people retire, there are few new workers to replace them.

There are also critical shortages in labor in manufacturing—Deloitte found that manufacturers are finding it Creating pathways for tomorrow’s workforce today now then in 2018—even though unemployment is higher. The problems in manufacturing are similar as for transportation: older, skilled workers are retiring and aren’t being replaced. Younger workers aren’t considering manufacturing jobs because they don’t offer the work-life balance or the compensation these workers are looking for.

Women are also underrepresented in the industry—they make up only a third of manufacturing workers. Worse, the Association of Equipment Manufacturers reports that one in four women in manufacturing are considering leaving their positions. Poor inclusion may be preventing the industry from adequately accessing this potential pool of qualified workers.

Challenge 4: Challenging Business and Economic Environment

The pandemic lockdowns caused border restrictions and delays for mechanical manufacturing products. It’s been responsible for port closures around the world causing congestion at ports, and slower shipping times. It has also reduced production capacity around the world.

A clear example of this is China’s zero-COVID strategy. The severe lockdowns in several major Chinese cities have intermittently shuttered factories, slowing the production of many goods. This has caused a ripple effect across supply chains in many industries, including car manufacturing and electronic parts.

The pandemic has had a significant impact on supply chains, but it’s not the only story.

Russia’s invasion of Ukraine—and the resulting sanctions—have disrupted trade routes, reduced the availability of raw materials, and increased energy costs. According to Forbes, there are 374,000 businesses around the world with Russian suppliers. Another 241,000 rely on Ukrainian suppliers, which are also likely to be disrupted as a result of the conflict.

Further west, the UK’s separation from the EU has increased cross-border checks slowing the entry and exit of goods. Tighter immigration rules have also compounded labor shortages. Both of these have caused delays in supply chains throughout Europe.

Challenge 5: Equipment Availability

In addition to the above, many industries are finding that a lack of equipment is obstructing the movement of goods. According to a report by Flexport, all major freight carriers are facing a shortage of containers, especially at ports in Asia.

This has caused congestion at ports and delays in product unloading. Some research suggests that containers now spend 20% more time in transit than they did before the pandemic.

The shortage in equipment is likely to persist as trucking companies face pressure to decarbonize fleets. The move to more sustainable equipment will require significant investment in new equipment.

The effects on consumers and businesses

Supply chain disruptions have a number of important implications for individual consumers, businesses, and economies.

- Slower economic growth. Supply chain challenges reduce companies’ ability to produce and sell goods. This slows down trade and hampers economic growth.

- Increased shipping costs. The cost of transport is going up. The European Central Bank has characterized the rise in price as “skyrocketing”.

- Increased cost of goods. Increasing shipping costs mean reduced profits for companies and more expensive goods for consumers. In that way, supply chain challenges contribute to inflation.

How to combat supply chain issues

Given that many of the supply chain challenges we are currently experiencing are expected to persist, what can companies do? Here are a few actions companies can take.

Create a risk management plan. Start by identifying potential supply chain risks and then assess your current risk. Create systems to monitor risks and develop plans to limit and mitigate them.

Diversify suppliers. By diversifying suppliers you spread out the risk and reduce the impact of a supplier disruption. On-demand supplier marketplaces, like the one we offer at ManuFuture, can help you source a number of potential suppliers for your manufacturing needs. If there’s a disruption with one supplier, marketplaces allow you to easily find another.

Budget for higher costs. Fuel costs are increasing, and so are the costs for shipping. That means the price of materials for businesses is likely to increase, as are the products made with those materials. Companies can account for the extra expenses in their budgets.

Prepare for delays. To mitigate swings in demand, companies can ensure that they have extra inventory available to act as a buffer.

Choose lower-risk suppliers. Not all suppliers are created equal. For example, ManuFuture guarantees on-time delivery of parts. If your parts are late, you get a refund. Choosing suppliers with guaranteed delivery helps reduce the impact of supplier disruption.

Supply chain challenges bring new opportunities

The supply chain challenges we are seeing now may not last. There are some signs that they may ease in the second half of 2022.

But a lot of uncertainty remains. The future remains unpredictable. Now is the time for companies to work to make their supply chains more resilient and mitigate risks.

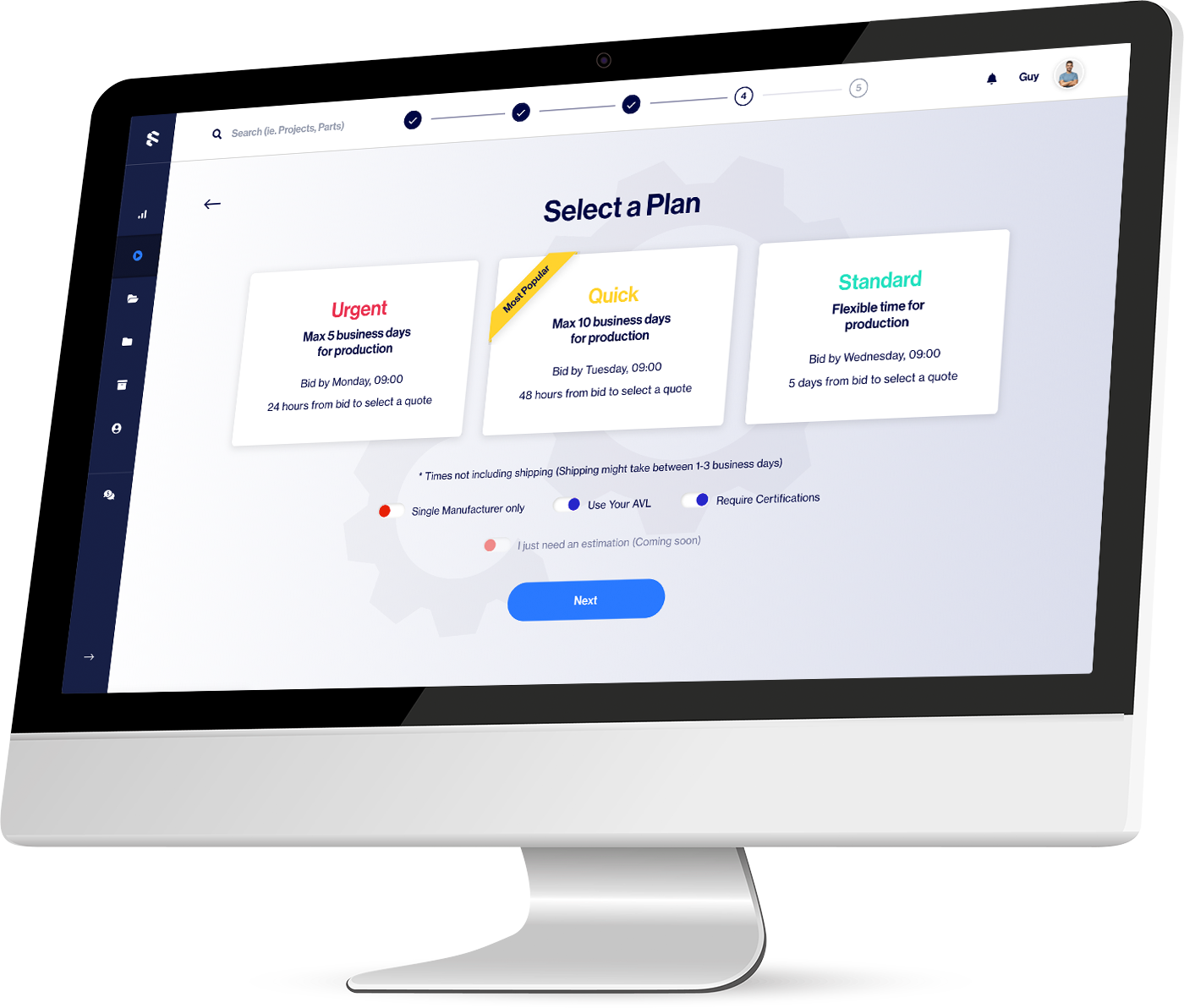

ManuFuture helps diversify your supplier base and mitigate risk. We offer the only BID-based, end-to-end transparent platform for mechanical custom items. Just upload your production files, and then define your engineering and commercial requirements. Within 24h you will get quotes for vetted vendors across the globe. All you have to do is choose the one that best suits your needs and issue an order on the platform. We will take care of rest, including PO’s and payments to the suppliers, shipping and clearance—guaranteed.

Try ManuFuture for your next custom project.